A B-B-BIG OVERHAUL

How the One Big Beautiful Bill Act 2025 Impacts the Taxpayer

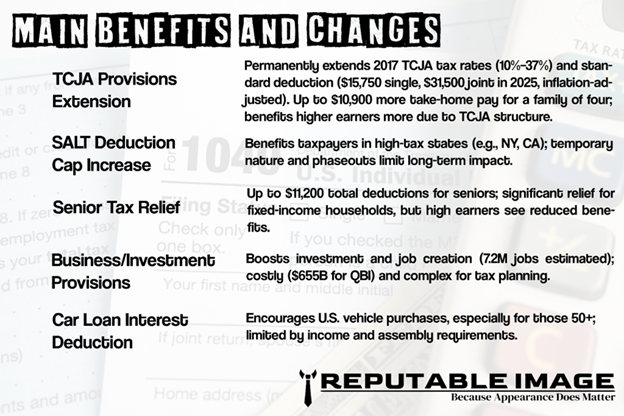

The One Big Beautiful Bill Act (OBBBA), signed into law by President Donald Trump on July 4, 2025, is a game-changer for American taxpayers, promising a mix of tax cuts, new deductions, and bold economic shifts. From keeping more of your hard-earned money to navigating new financial challenges, this sweeping legislation reshapes the tax landscape for families, seniors, and businesses alike. This article dives into the key implications of the OBBBA, breaking down what it means for your wallet and how to prepare for its far-reaching effects.